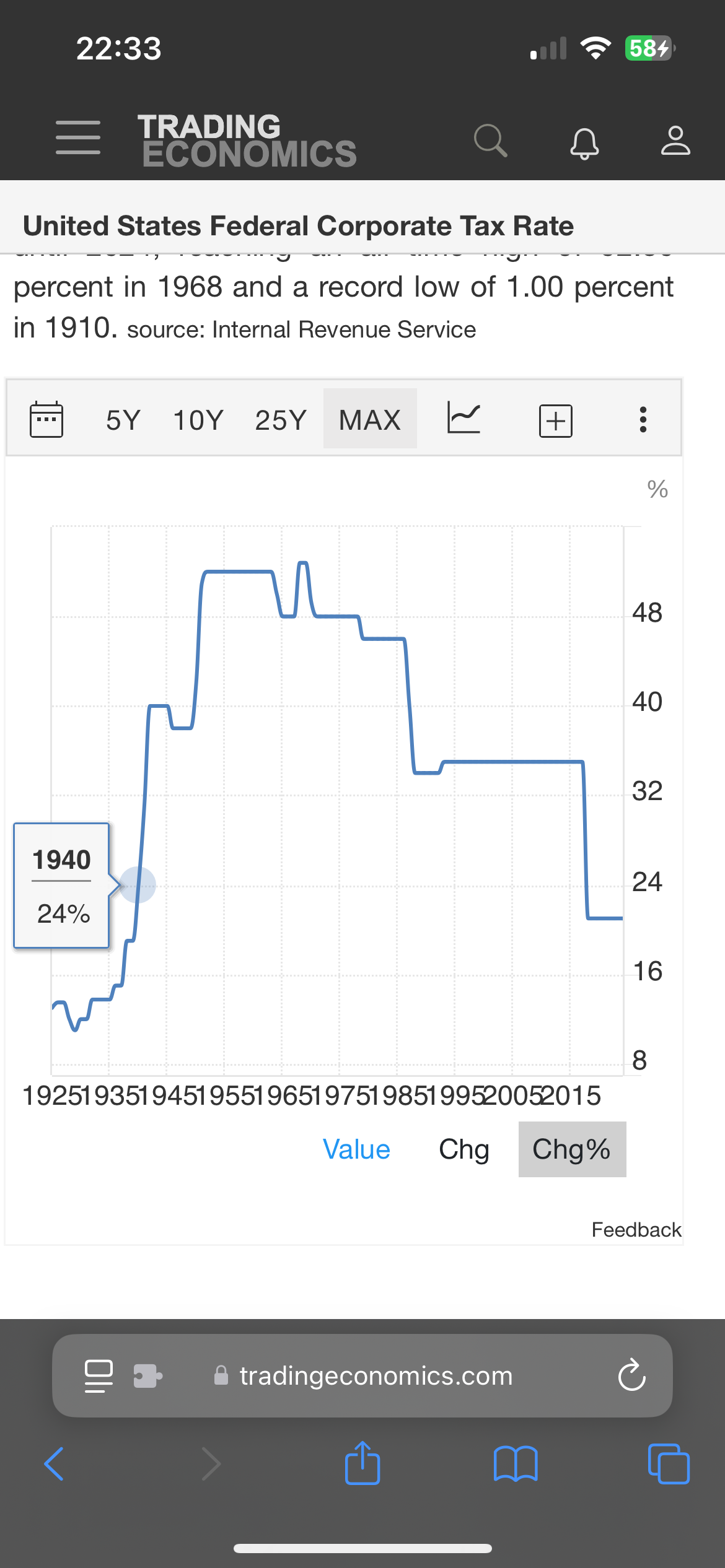

Republicans love to harken back to “the golden age” of america. Ever wonder what paid for it? A big portion was … corporate tax!

https://taxfoundation.org/data/all/federal/historical-corporate-tax-rates-brackets/

Corporate tax is currently at the lowest point since 1940

https://tradingeconomics.com/united-states/corporate-tax-rate

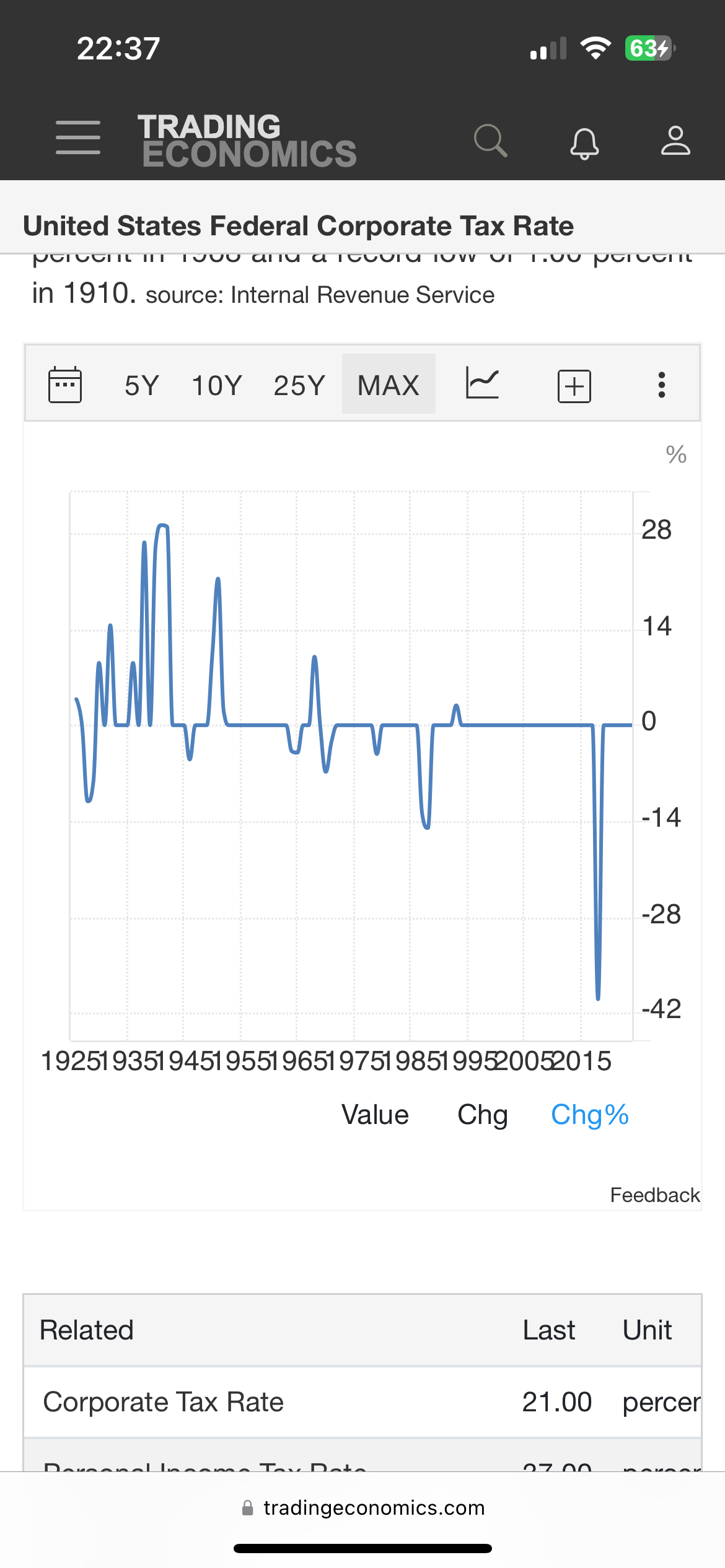

See this big drop in corporate tax? You thank ol’ trumpy for that

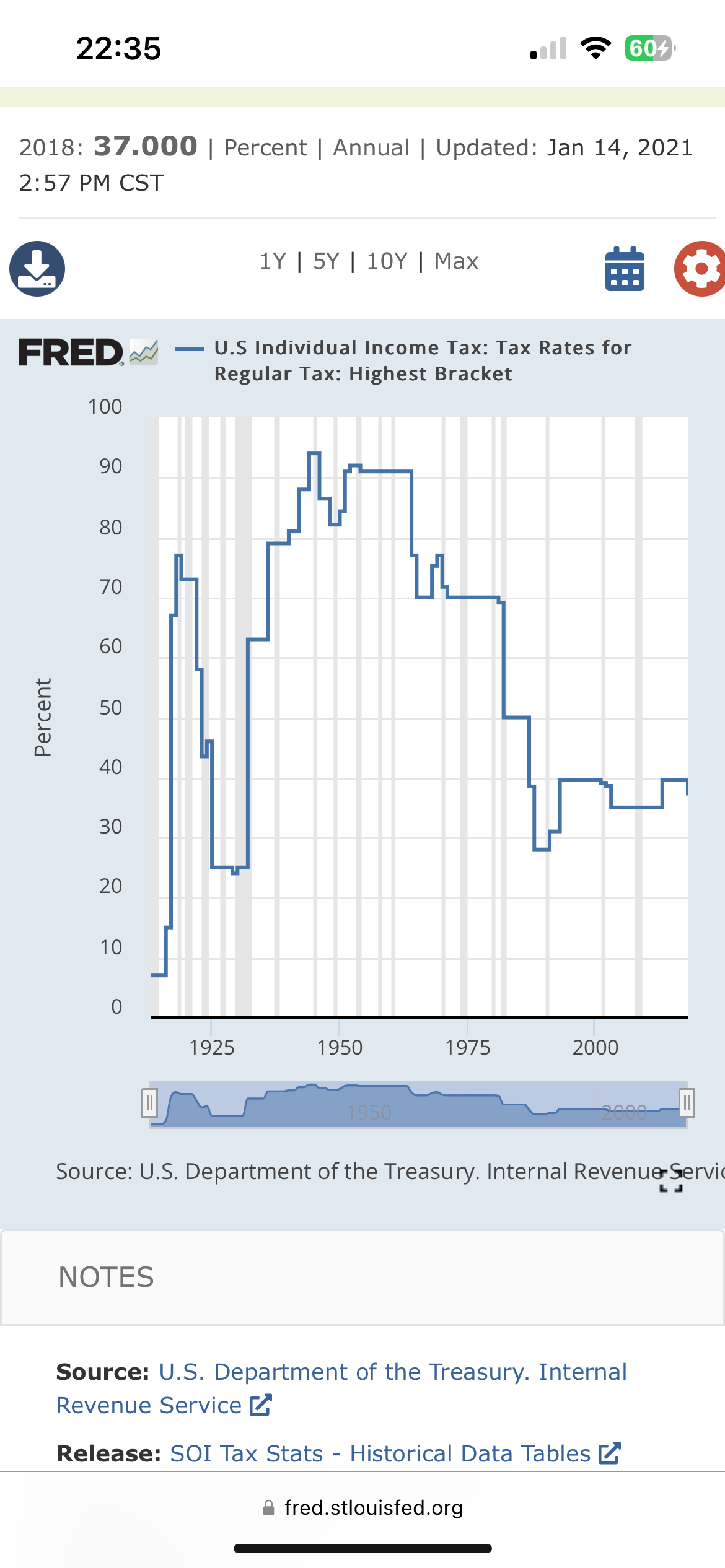

Along with personal income tax - Note this is the top bracket of tax

https://fred.stlouisfed.org/series/IITTRHB

Want your golden age back? Tax these fucking billionaire grifters.

Another thing that raising the corporate tax rate does is make it more profitable to re-invest your income into the company. Since they’re only taxed on profits they’ll pay zero taxes if they make zero profit. How do you do that? Expanding your business, spending money on R&D, and paying your employees more.

Edit: Haha, just kidding, they’ll blow it on stock buybacks.

Ideally, yes - but until share buybacks are outlawed - companies will just ‘reinvest’ by buying up shares (increasing their price, and thereby existing shareholder wealth), and issuing them as bonuses to their C-suite in lieu of payment… by-and-large avoiding a lot of the income tax that they would otherwise be due to be paid.

Our current late-stage capitalist corporate system is built upon layers and layers of tax-avoidance and self-enrichment at the cost of society as a whole.

deleted by creator

this isn’t science, it is story telling

Then put them all in the prisons and enslave them, as is legally allowed per the Constitution. They’ll work with sufficient coercion. Have the CIA seize their overseas assets and repatriate it all, or if it’s in a hostile country, have the CIA exfiltrate or destroy as necessary. Humans will work when enough physical and psychological pain is applied to coerce them. That, too, is human nature. If they attempt to flee, have the CIA find them, put them in unmarked vehicles, and extradite them back to US soil to be put back to work.

Reminded of wtfhappenedin1971.com

The numbers, what do they mean?

deleted by creator

I stated both. I listed both corporate and personal tax. What are you referring to?

edit - do you mean the personal bracket?

deleted by creator

I thought I had a problem with taking a point or two and stretching them across a handful of paragraphs. I no longer think I have a problem and indeed have learned a few things to limber up and aim for greater mental gymnastic heights.

You’re not just a fly in history’s wall, to hear you retell it, you can read hearts and minds better’n than most deities too. A graph tells a shaky story but your certainty of the intent of every actor involved is inviolate?

Please don’t write back at me, for the first time in my life, I comprehend the fear of my acquaintanceships and the long rambling.

Fucking insane that 28% is a tax hike.

Should be no less than 90%, like it used to be.

You have to bear in mind that the “like it used to be” part operated when digital card payments were not a thing. A customer would give you cash, and maybe you would write it down in your taxes, but there was no digital indicator of what actually happened.

Small business owners got to stay afloat by swindling the government, and this was the normal way for centuries.

I’m not saying it’s right, just that the high business tax of the past wasn’t as effective as you think it was, and will hit extremely differently this time around in the digital era.

The best thing to have is a variable tax rate that goes up the more profit is made.

That’s how it is in my country.

That used to be the case until 2017. Highest bracket was 39%, but they had a weird system where it went UP until about 350Kish, (Income between 100K~350K) and then the variable rate started dropping again for income past that, back down to 35%. Would have been fair to assume any fortune 500 company not doing shady shit would have paid an effective rate of 35%.

Trump’s tax cuts drastically decreased that, down to 21% flat for everyone. 28% would still be a tax cut over what it was up til 2017.

From what I know, most of the big international companies can bypass almost all taxing anyways because they simply move their profits trough tax havens. We should be looking to fix that first.

what if a company decides to split up into 100 smaller companies to avoid taxation?

Good?

Smaller businesses have better wages and hire more people. Smaller businesses are more nimble, flexible, and they’re never too big to fail. Smaller businesses, mean more options, more ideas, and variety is good for the marketplace, consumer, and the country as a whole.

Less consolidation is good! Competition is good!

Competition is good!

I wonder when AI “competition” will crush the free market.

Smaller businesses are more nimble, flexible, and they’re never too big to fail.

Some of this is questionable and other bits are flat wrong. Small businesses have bigger lending costs and less slack in their workforces, so they’re often contained to focusing on a niche field.

And after a break up or spin off or outsourcing effort, certain components of the old business can become lynchpins for the rest.

That’s basically the story of Cloud Strike. Much smaller than it’s clients, but still too critical to be allowed to fail.

And just because a business administration is broken up doesn’t mean it’s revenues are. Modern conglomerates - Berkshire Hathaway, and Citadel Investments being the most notorious - have big stakes in enormous swaths of private industry. They control enough board seats to function as economic central planners.

Buffet doesn’t really care if he owns one big Coca-Cola or a thousand little ones, just so long as he continues to extract that sweet sweet labor value.

Identify them then seize all of their assets IMO.

yeah but you could do that with one big company just as well. that has nothing to do with them splitting up

That’s fraud and illegal.

I’m pretty sure that it would be practically impossible to prove in practice that it’s fraud and illegal.

Not at all. Just follow the money.

deleted by creator

Are you including the fact that $100,000 in the 1950s is more than $1million after accounting for inflation?

According to some quick googling, $1,300,000 is the modern equivalent of $100,000 in 1950. That would put you in the top 5% earners (and very nearly in the top 1%). According to the IRS, the top 5% contribute about 65% of the tax burden.

The top 25% make up about 90% of contributions, but that starts around $70,000 annual income.

that is fascinating… do you have some longer easy to read source to learn about this topic?

also, you say those earning 100k in 1950’s only carried 20% of tax burden and now they carry 80%… what exactly is tax burden and is that number inflation adjusted? how big fraction of income distribution are we talking about?

I’m afraid to ask, but what is the current number?

Currently a flat 21%

Flat? Meaning all corps pay the same regardless of revenue?

I almost pay that already. No wonder they have no public health services shit police, school issues.

Awwww… Raise it above the old 35% tax rate at least.

It’s still a start, and something more likely to get though congress

49% is golden. But 28% is a start.

Staggered based upon gross income just like personal taxes.

Tiny businesses 5% Small businesses 25% Mid sized companies 50%. Mega-corporations wth billions - 95%

One problem with that is that companies could create a ton of subsidiaries or shell companies and move money around in funny ways to keep all of them at the lowest bracket

Sure. Gimme a progressive tax rate across the board.

And index it against inflation. 😉

No better: to the cost of living index. That way if they pump prices up like they have in the last few years, they choke themselves with their own rope.

God I can’t wait until US news headlines aren’t tainted with the name Trump. I’m so tired of it all.

There is one headline with his name that I can’t fucking wait to see.

Yeah me too but then the guy missed.

…Oh wait, you mean the other headline.

Personally, I was going for the McHeartattack option.

I’m hoping it’s a Stroke, man!

There’ll always be someone else. But we may have a bit of silence when Trump is gone.

deleted by creator

I know, I’ve just waiting for this turd to flush since 2016

We all have. Damn shame he turned out to be a floater, but let’s hope this time does it.

Time defeats all men. His clock is ticking.

While true, it would be a more reassuring fact if hadn’t ample time still to make a huge dent in both America and the world at large before he goes.

deleted by creator

He shouldn’t even be allowed to run, how can you foment a coup and still run for President. Failed state

Same here. I was exhausted with his run in 2015/2016 and being the king of the birthers and hoped his loss would put his stupid name behind us and he could go back to trying to make a name for himself with morning zoo DJs or wrestling or whatever the fuck.

I despised the guy even before he was given that stupid game show. It got even worse when he “won” in 2016.

I just can’t wait to never hear of this dude ever again, or see his name or his anus mouth. It’s been a fucking agonizing 8 years with this mother fucker.

The amazing economy that these MAGA people dream of getting back to can be largely attributed to two things. The first is lots of manufacturing, which the CHIPS Act is a step in the right direction towards, but is impossible to ever really get back to ever since Nixon opened the door to China as a trade and manufacturing superpower in the 70s, and companies decided to lower costs by sending manufacturing over there. The second is a MUCH higher business tax rate. At one point, it was 91%. I’m not saying that that’s the correct rate in the modern economy, but 28% ain’t shit. Raise it to 40% at least, and then use that additional revenue to get everyday Americans’ heads above water.

I’m an extremely lucky 35-year-old American white guy, married with no kids or pets, denied ourselves several comforts and luxuries, and I’m still just now at a point where I’m trying to buy my first home. I have almost every advantage possible, and I’m still over ten years behind my parents’ generation. That shit ain’t right. Help us, the people.

The higher the corporate tax rates the more the companies reinvest into the company to keep profit margins down which causes the economy to flourish rather than funneling as much cash as possible to shareholders.

Companies generally would rather pay their own workers more than pay more in taxes. If you’re going to lose the money anyway, might as well spend it keeping your workforce happy than give it to the government.

You might be right, but what’s silly is that you think companies wouldn’t do everything in their power to not reduce pay to both workers and the government at the same time. And they do. In fact, they lobby endlessly to lower their taxes as well as keep wages low, loosen regulations, dismantle the power of unions, roll back labor rights, and take away voting power of the people who would vote against their interests. You need to understand that the entire motivation of these companies is to maximize profit at all costs. “If you’re going to lose the money anyway” is not something they have ever or will ever accept. That’s like assuming that you accept that you will never eat another scrap of food ever again. Your survival depends upon it, and when access to it is threatened, you will lie and cheat and steal as much as is necessary to ensure your survival.

If the government taxed businesses at a higher rate and used that increased revenue to improve the quality of life and access to opportunities for all, I’d say that that’s a much better use of that money. We’ve tried taxing businesses less in hopes of having anything other than piss trickle down to the workers. That’s how we got here. Productivity has boomed, yet wages have stagnated and people are struggling to get by. It’s time to stop propagating broken bullshit-ass Reaganomics and start advocating for your fellow human to be able to afford access to the bare minimum of food, shelter, and medical care. The GDP of the US is over $25 TRILLION. So why in the blue fuck are people still freezing and starving to death in this country? Unacceptable.

Yes it would be ideal for the government to do all that, I’m just saying that increased corporate tax rates lead to increased reinvesting into the companies themselves which is generally good for workers. Part of them avoiding paying taxes would lead to working at those companies being better because pushing pure profit margins wouldn’t be as effective for gathering wealth. There are so many companies where it is downright miserable working for them due to rampant cost cutting to make record breaking profits, so tax the fuck out of those profits and stupid choices like that become less fiscally appealing.

For instance In order to boost profit margins at the end of last year 7 Eleven put a halt to all preventative maintenance. If it is no longer cost effective to do that due to high taxes on those profits that maintenance would have been done which would have seen a higher retention in maintenance staff. (As well as less money spent replacing equipment in 2024)

I’m not saying one change will fix everything, but it’s a start.

I understand you now. I’ve automatically assumed that “reinvest in the company” is just shorthand for stock buybacks lol. I was like wtf how is that good for the average person haha.

Congrats, I just bought a cottage because rents have gone insane

Rents have gone so insane that (assuming everything goes smoothly and we close) we will spend like $500 less per month by moving from our 2 bedroom apartment into a 4 bedroom 1800sqft townhouse. It’d be even less if interest rates weren’t dog water right now haha. But there was only one other family competing to go under contract, so the high interest rate is how we got ahead of the upcoming gold rush. Houses are about to go for much higher than right now.

Does it really matter what the rate is when they don’t pay it anyway?

"The analysis names 35 corporations, including Tesla, Netflix and Ford, that each reportedly spent more on compensation to their five highest-paid executives than they paid in federal income taxes over five years.

Collectively, the 35 corporations spent $9.5 billion on their top executives over that span, the report said, while their combined federal tax bill came to -$1.8 billion: a collective refund."

Imagine if the law was no more can be spent in corporate executive compensation than the company pays in taxes. Idk if that’s a good idea for small corporations, but it’s a jumping off point.

We could set it so that companies whose CEO’s net worth is less than a half mil are exempt

Here’s a wild idea… tax corporations based on income, not profit.

As much as I like the idea it aint exactly a clean cut rule, a lot of companies operate on slim marjins due to loans or just that being how it is so taxing income could fuck over way more than just the greedy assholes. I do think taxing based off of stock prices should be a thing, the stocks reflect the physical value right? That means they should be able to pay the taxes.

I mean, when I pay my taxes, it’s based on how much money I earned, not how much money I have left over at the end of the year.

If the argument is “Corporations are people, my friend” they should be paying an income tax, same as anyone else.

Holy shit if a corporation is a person…

…does this mean a person is a corporation?

Man it’s so fucking straightforward for the IRS to see that Mom’s fettuccine restaurant is a little bit different from fucking Amazon, Meta, Ford etc from just putting all of it’s money into itself and calling it a loss.

Oh certainly but heres the thing we live in a legalistic society and the sons of bitches would figure out some way of fucking up that type of tax.

Well you brought up like the most manipulatable resource as a means of taxation, so I see why you feel they’d always win. I mean Trump’s entire career has been made simply lying about the value of his assets when it suited him. That’s not a “loophole”, inasmuch as it’s fraud that isn’t caught.

You want it to end? Give the IRS more money. Allow the FEC to attack monopolies and monopsonies. The rich simply lie and print advertisements convincing rubes to destroy the system. Regulate the news, advertising. “Ohh but mah freeze peach”, well then you get unregulated, untaxable, unrestrained capitalistic greed.

It makes sense. More income, more bonus. It would also prevent companies from handing out bonuses while operating at a loss.

I gotta tell ya, “is planning on increasing corporate taxes” seems like the right direction to me. So, yes.

Yes, there’s more to be done, obviously.

For someone who clearly knows how fucked the issue is that wording seems almost distracting from the road that will get us to a solution. It’s a good thing, let it happen.

What’s your conclusion? That we shouldn’t tax anyone at all?

Why isn’t your conclusion that we should find these husks of supposed humans and turn them inside out? Why isn’t your conclusion that chunks of SpaceX, chunks of Amazon, chunks of Google, should be rightfully owned by the American public?

Close the loopholes that let companies with billions in revenue pay 0 in taxes.

Because socialism generally speaking works really really badly? Taxation should ideally be zero, but since there are obvious things 99% of us agree that should be funded in a centralized way, we have to have taxes.

The point of taxes is not to make everyone equal, the point is to fund those important things. For instance: police, military, education, basic healthcare (perhaps), charity for the less fortunate and certain natural monopolies like utilities.

Lmfao “sOcIaLiSm bAd” “taxation is theft”

Socialist policies would bake those “important things” into centralized structures owned and managed by the people. You’re beyond propagandized if you believe the people should own fucking natural utilities but also believe “socialism is bad”. Like fucking pants on head retarded

And before you say “I’m socialist cause I argued companies should be owned by the government” — I’m saying that these companies have become monopolies at the behest and funding of their state and federal governments. They should be ripped apart and absorbed, like you argue “natural monopolies” should be.

Exactly. If the don’t close the loopholes then this means precisely dick.

I feel like I pay that now as a peon.

For an individual in 2024 to pay 28% of income in federal taxes, you’d have to make $500,000 according to this calculator.

Or be self employed.

State plus federal tax tho?

Not to mention health insurance and 401k (to replace pensions).

Our take home percentage is much lower than a few decades ago. Not to mention cost of living: housing and food.

The GOP wants to take America back to when it was “great,” as long as “great” ignores when the rich and companies paid their fair share for infrastructure, schools, etc.

God forbid we actually decided to pay for those things again and stopped letting the country rot.

Shocker, things go to shit when you don’t pay for them and or sell them off to private companies. Looking at you, Starliner capsule.

Fuck…I pay that , and more on bonuses I receive.

Let them pay more.

This. In canada the corporate tax rate is 29% for income. 19% for companies. Tax em.

This is SO BAD for the Economy! All those Job Creators laying off Tens of Thousands of Workers will MOVE! We need to Tax the HOMELESS instead! I’m Fiscally Responsible Republican!

I’m game for over 50% really

What was it before Trump?

The article says 35

Republicans take great strides backwards. The limit of our ambition is baby steps forwards.

If corporations were being honest, they’d acknowledge that’s a bargain.

If corporations were being honest

When has that happened?

I’m with you, though. I’ll dream…

Talk about taxing private citizens who have more money than some nations.

Pre-80s tax rate for the wealthy was 70%.

That needs to be restored.

After all the price gouging gains and PPP loans going to lining the pockets of owners buying themselves ferraris, let’s up it to 85%. They’ll manage. Since corporations are people, they can just pull themselves up by their bootstraps.

Not our problem.